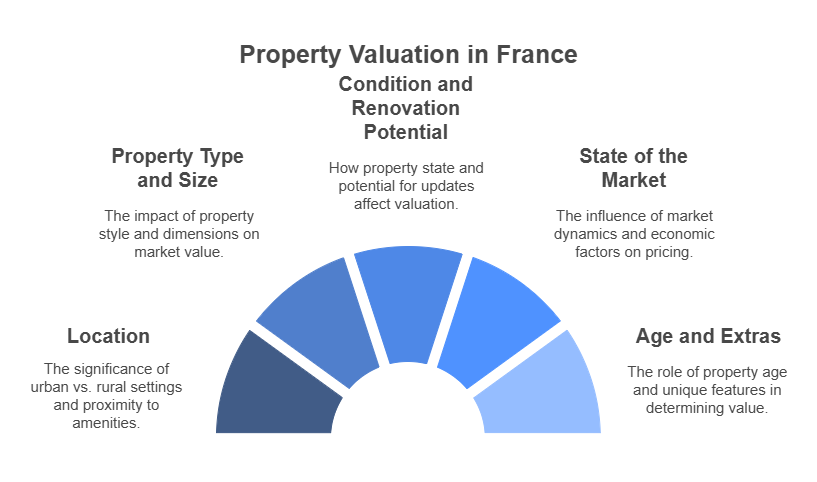

6 Factors That Determine the Price of a Property in France

When buying or selling property in France, understanding the factors that influence property prices is essential. The French real estate market is dynamic, with prices varying significantly depending on several key elements. Whether you’re a buyer or seller, here are six critical factors that determine the price of a property in France.

1. Location, Location, Location

The property’s location is the most significant determinant of its value. Urban areas, such as Paris, Lyon, or Bordeaux, command higher prices due to demand, employment opportunities, and amenities. In contrast, rural properties in departments like the Charente or Dordogne may offer lower prices but appeal to those seeking tranquillity and charm. Proximity to transport links, schools, and tourist attractions can also affect the price significantly.

2. Property Type and Size

The type of property—be it a cosy apartment, a sprawling château, or a rustic farmhouse—plays a significant role in its valuation. Larger properties with extensive land, additional outbuildings, or unique features tend to fetch higher prices. Buyers looking for second homes or holiday rentals may favour properties with pools, while families or retirees may prioritise spacious homes with modern conveniences.

3. Condition and Renovation Potential

A property’s condition impacts its market value. Newly renovated homes or properties in pristine condition generally attract higher prices. Conversely, homes requiring extensive renovations may be more affordable upfront but could involve additional costs for modernisation or compliance with building regulations. Properties with renovation potential are particularly popular with buyers looking to personalise their homes or invest in rental properties.

4. State of the Property Market

The state of the French property market can influence pricing. In a seller’s market, where demand outstrips supply, prices tend to rise. Conversely, in a buyer’s market, with more properties available, buyers may have room to negotiate lower prices. Economic factors, such as interest rates and changes in tax policies, also affect demand and, consequently, property prices.

5. Age of the Property

The age of a property can have a considerable impact on its price. Historic homes, such as stone cottages or 18th-century farmhouses, often come with a premium due to their charm and heritage. However, they may require ongoing maintenance and upgrades, which can influence buyer decisions. Modern builds with energy-efficient features or compliance with current building codes are highly sought after and can command higher prices due to their low running costs and minimal maintenance needs.

6. Extras: Pools, Gîtes, and Unique Features

Properties with additional features such as swimming pools, separate gîtes, or landscaped gardens often attract higher prices. These extras enhance the property’s appeal, particularly to buyers seeking holiday homes or investment opportunities. A home with a gîte, for example, can generate rental income, while a pool is a significant draw for buyers looking to enjoy long summers in France. Other features, such as a outbuildings, views, or no near neighbours, can also add value.

Conclusion

Understanding these six factors can help buyers and sellers navigate the French property market with confidence. For buyers, it’s essential to consider not just the price but also the potential for growth and the lifestyle the property offers. For sellers, showcasing the property’s strengths—such as location, condition, or unique features—can help achieve the best possible price.

Are you looking to buy or sell property in France? Contact our expert team for personalised advice and guidance tailored to your needs.

€837,400 HAI

Cierzac, Charente-Maritime

€556,500 HAI

Asnières-sur-Blour, Vienne

€2,014,000 HAI

Asnières-sur-Blour, Vienne

€784,400 HAI

Barbezieux-Saint-Hilaire, Charente

€222,600 HAI

Aubeterre-sur-Dronne, Charente

€229,000 HAI

Saint-Paul-Lizonne, Dordogne

€339,200 HAI

Brux, Vienne

€253,340 HAI

Alloue, Charente